The Data Value Chain: A New Paradigm in International Taxation

The battle over taxing digital data has evolved beyond simple revenue grabs into a complex debate about value creation in the modern economy. This raises fascinating practical challenges that current tax frameworks struggle to address.

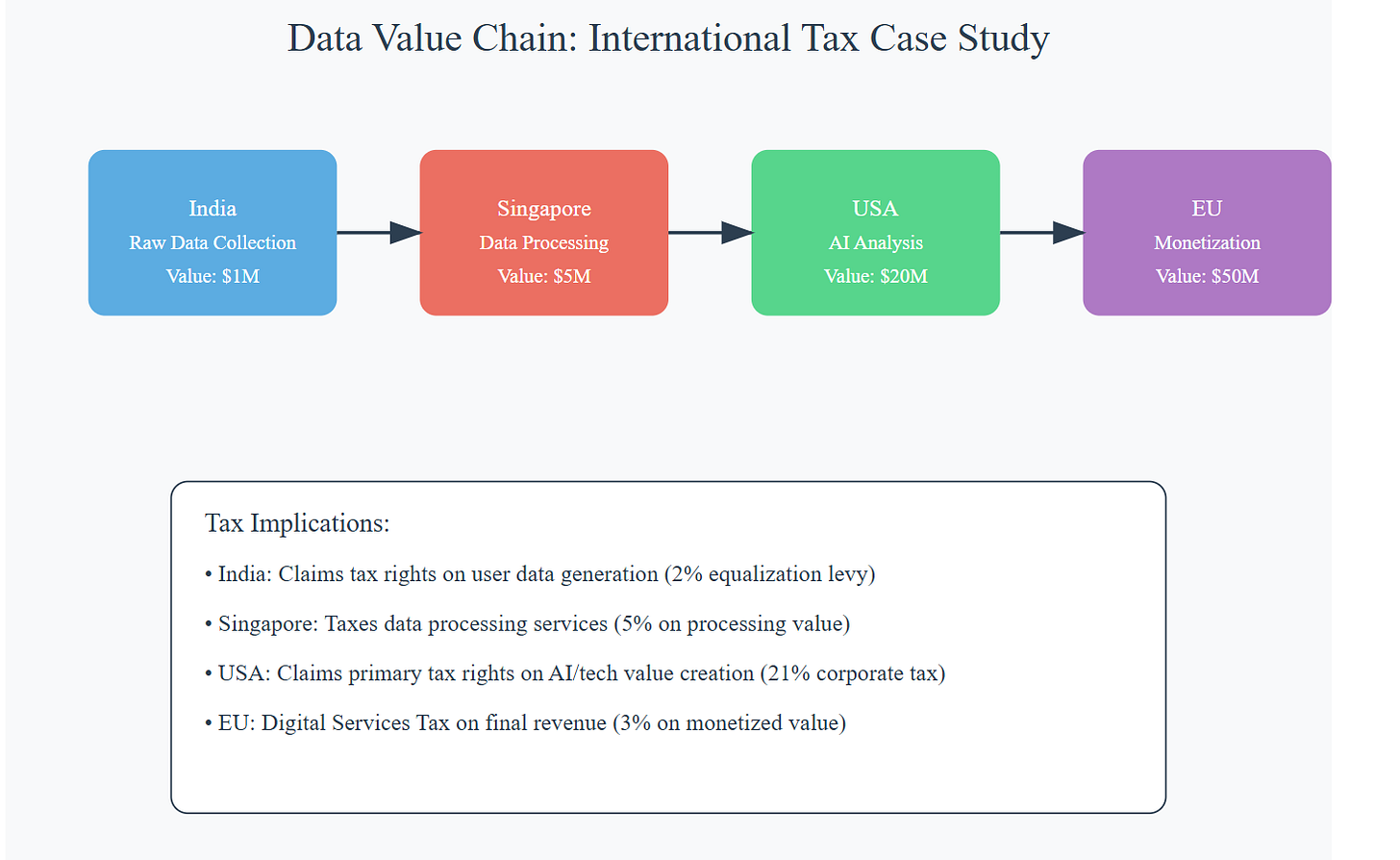

Value Creation Paradox Data moves through distinct stages of value creation:

Raw data collection (minimal value)

Data processing and organization (moderate value)

Data analysis and insights (significant value)

Monetization through targeted ads/services (maximum value)

Each stage typically happens in different jurisdictions. Indian users generate raw data, Singapore processes it, U.S. algorithms analyze it, and European advertisers pay to use it. Which country can claim the taxing rights?

Practical Measurement Challenges Companies are developing sophisticated approaches to value data:

Volume-based metrics: Cost per thousand data points

Quality metrics: User engagement levels, demographic value

Enhancement value: How much processing improves data worth

Revenue connection: Direct link to advertising income

Tax Authority Responses Countries are taking innovative approaches:

Brazil treats data processing as a service, taxing it under service PE rules

Israel focuses on "significant digital presence" including data storage

Australia examines data flows in transfer pricing audits

Singapore offers incentives for data analytics activities

The Future Challenge The next frontier is AI-generated data. When an AI system trained on Indian user data creates new synthetic data, which country has taxing rights? Some countries are already developing "AI-sourcing" rules.

Transfer Pricing Innovation New valuation methods are emerging:

"Data lifecycle" approach: Tracking value added at each stage

"Network effect" multipliers: Increased value from data combinations

"Machine learning premium": Extra value from AI training data

The solution likely requires rethinking basic concepts:

Moving from "permanent establishment" to "digital presence"

Developing clear rules for data value attribution

Creating standardized data valuation methods

Establishing multilateral agreements on data taxation

This challenge will reshape international tax principles as countries compete for their share of the digital economy's most valuable asset.